By Spencer Wesley, Realtor®, Dental Practice Broker

The Prime interest rate in May 2022 was 4.0% and by May 2023 it had risen to 8%, an increase that would give pause to anyone who’s been thinking about buying a dental practice. I’m here to say that if you want to own a practice, don’t put your plans on hold because of higher interest rates. Here are a few things to keep in mind as you weigh your options.

Interest Rates Are Not a Deal-Breaker

Let’s start with a little perspective. Low interest rates over the last decade were more of an aberration than the norm. Back in 2008 when the housing crisis triggered the Great Recession, the Federal Reserve slashed interest rates to prevent the U.S. economy from sliding into a full-blown Depression. Now the enemy is inflation and the Fed’s remedy is to raise rates.

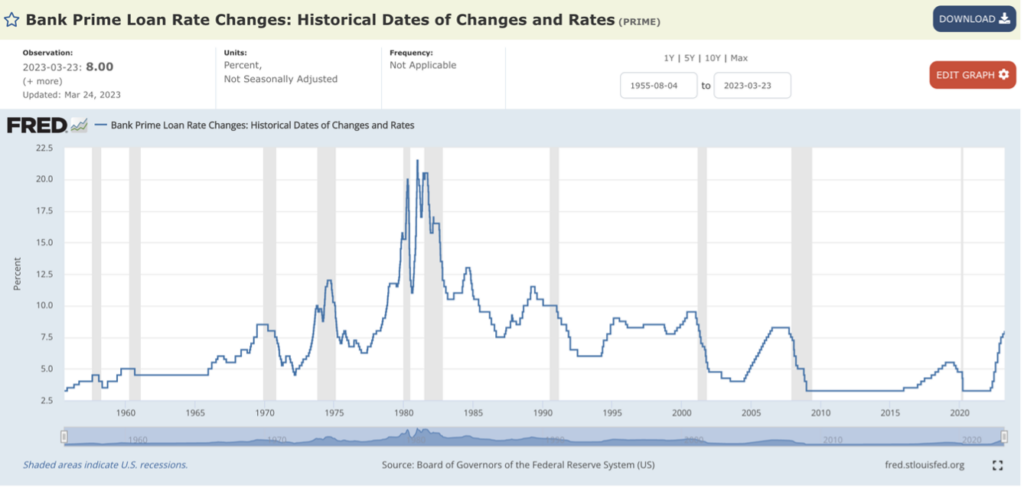

That, in a nutshell, is the story of interest rates. As the Federal Reserve chart below shows, they continuously rise and fall based on current economic conditions. Some dental practice owners today remember a time when interest rates for practice acquisitions were 15% to 20%. Even in the last 20 years, they’ve been as high as 8-10%. Consider it proof that you don’t need historically low interest rates to be successful.

Don’t Try to Predict the Future

Some economists have been predicting a recession since the Fed began raising interests rates in March 2022. Other economists point to the low unemployment rate of 3.5%, along with continued strong consumer spending to support their belief that instead of a recession we’ll have a soft landing. Meanwhile, The Wall Street Journal reported recently that more than 1000 officers and directors at 600 companies recently acted to buy back their own stock, a clear indication that they believe their companies are worthwhile investments. Occurring shortly after the collapse of three U.S. banks, it signals corporate optimism, which is good news for the economy.

The bottom line is no one can predict the future, so you shouldn’t put your career on hold waiting for the perfect economic conditions. Like interest rates, market economies go up and down. They always have and they always will.

Focus on the Fundamentals

Instead of worrying about interest rates when you look at buying a practice, here are some numbers you should be concerned about:

- Collections – Find out how much revenue comes into the office, including all the insurance and patient payments that have been generated by the practice’s production.

- Profits – Dental practices in the U.S. have an average profit margin of about 40%. Anything below that could be a sign of problems.

- Overhead – The total of all expenses related to running the practice should not exceed 60% of collections.

In addition to the financials, it’s just as important to find a practice that’s a good fit for you. That includes taking into account factors such as:

- Location of the practice

- Size of the practice

- Type of dentistry practiced and the required technical skills

Don’t Be Afraid to Go for It

It was inevitable that the historically low interest rates we enjoyed over the last decade would go up. I agree, it’d be nice to have a lower mortgage payment, but ultimately, that’s not what will make or break you.

Dentistry is a resilient industry. If you want to be a practice owner, my advice is to go for it. Life is too short to wait for things to be “perfect.” It’s better to find a practice that works for you and then put good systems in place so you can build a successful business.

If you have questions about buying a practice, contact or give us a call at Engage Advisors. We can provide the support you need for a good transition that lays the groundwork for a satisfying and successful career.